When Do I Need to File

Form 990-PF?

Nonprofit Tax filing deadlines can vary depending on the organization's accounting period.

For Calendar Tax Year (January 1st to December 31), the

due date for filing Form 990-PF is May 15th.

For Fiscal Tax Year

(other than Calendar Tax Year), Form 990-PF is due on the 15th day of

the 5th month.

Note: If the due date falls on a Saturday, Sunday, or legal holiday, file by the next business day.

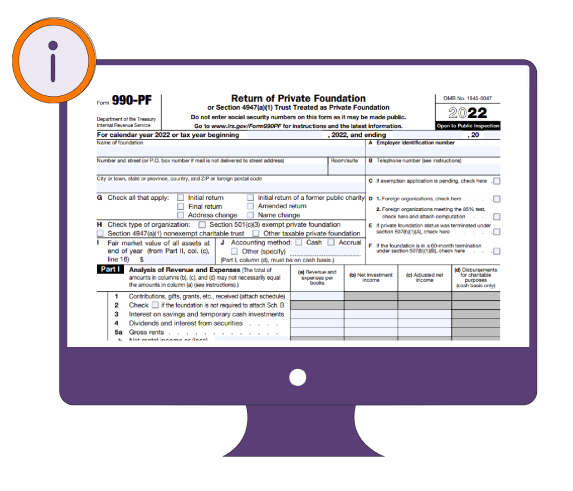

Information Required to File Your Form 990-PF Electronically!

The private foundations should provide the following details for filing their

Form 990-PF.

- The Organization’s basic Information

- Financial information such as revenue, expenses, assets, and liabilities

- Program-related investments

- Other IRS filings and tax compliance requirements

- Key personnel, governing body, and management details

- Type of organization

Simplify your Form 990-PF Filing with Our Comprehensive Software!

Includes Free Form

990-PF

Schedule B

Copy Prior Year Data

Flexible Form Preparation Options

Retransmit your Rejected Returns

for Free

Supports 8868 Extension Form

Live customer Support via Chat, Phone, and Email

How to E-file your Form 990-PF?

File your Form 990-PF with our e-filing software and experience easy and secure filing.

Add Organization’s Details

Choose the corresponding Tax year

Enter the Form Data

Review Your Form Summary

Transmit Your Form 990-PF to the IRS

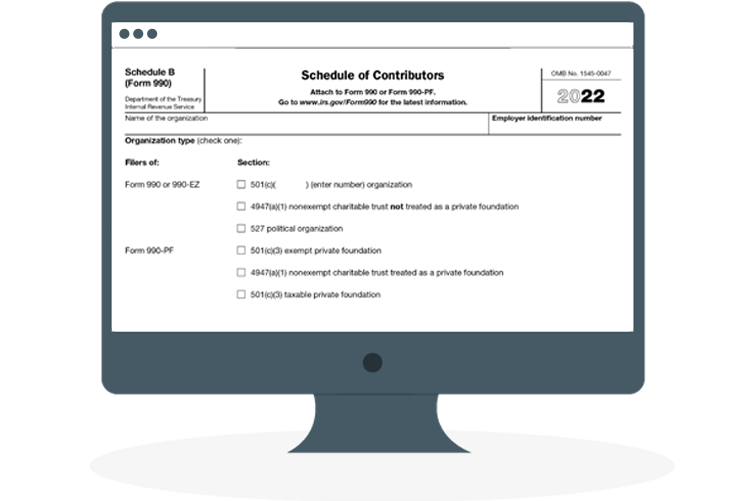

Additional Requirements to File

Form 990-PF

If the private foundation receives $5,000 or more from any one contributor during the corresponding tax year, they must file Form 990-PF Schedule B.

A contributor may include:

- Individuals

- Partnerships

- Associations

- Exempt organizations

- Fiduciaries

- Corporations

- Trusts

Frequently Asked Questions

for

Form 990-PF

1.

What is Form 990-PF, and who must file it?

Form 990-PF is an annual information return filed by private foundations to report their financial details, activities, and more for the corresponding

tax year with the IRS.

Primarily, Form 990-PF must be filed by,

- Tax-exempt private foundations.

- Taxable private foundations (section 6033(d)).

- Section 4947(a)(1) nonexempt charitable trusts treated as private foundations.

2.

Is there any Extension form available for Form 990-PF?

Yes! In some cases, Private foundations may require more time to prepare their Form 990-PF. They can file Form 8868 and get an automatic extension of up to 6 months from the IRS.

3.

What are the late filing Penalties for Form 990-PF?

The IRS may impose penalties for filing Form 990-PF late or filing with incorrect information. The penalty amount varies based on the organization’s size.

Smaller Organizations (gross receipts < $1,129,000)

The Maximum penalty of $11,000 or 5% of gross receipts

For Larger Organizations (gross receipts > $1,129,000)

The Maximum penalty of $56,000 or 5% of gross receipts

4.

What is Automatic Revocation?

Under the law, the private

foundation’s federal tax-exempt status is automatically revoked when they

fail to file Form 990-PF

for three consecutive years.